Freshbooks vs Quickbooks: what’s the difference, and which is actually right for you?

If you freelance or run a business, you probably need to a tool to track revenue and expenses, send invoices, and maybe even run payroll. Freshbooks and QuickBooks are two of the top tools in this space.

This post takes an in-depth look at both options, comparing the good, the bad, and the downright ugly. Let’s dive in!

Meet the Contenders

Meet Quickbooks

Quickbooks has been around for a long time, so it’s no surprise that it offers a comprehensive set of tools for businesses and freelancers.

Quickbooks offers expense-tracking, mileage-tracking, accounting, and invoice creation, as well as a multitude of features for working with your own accountant.

Meet Freshbooks

Freshbooks is an industry-leading small business accounting and invoicing solution. Since they focus exclusively on small-business, they’ve got some powerful features that are a great fit for this niche.

In addition to basic accounting, expense-tracking, and invoicing, Freshbooks also offers time-tracking, client management, and more.

Accounting & Expenses

Both Freshbooks and Quickbooks allow you to link credit cards and bank accounts so you can track business expenses automatically. Both support inviting your accountant so they can support you during tax season. And both have automatic reporting to help you keep tabs on how you’re doing.

What’s different, though, are the interfaces.

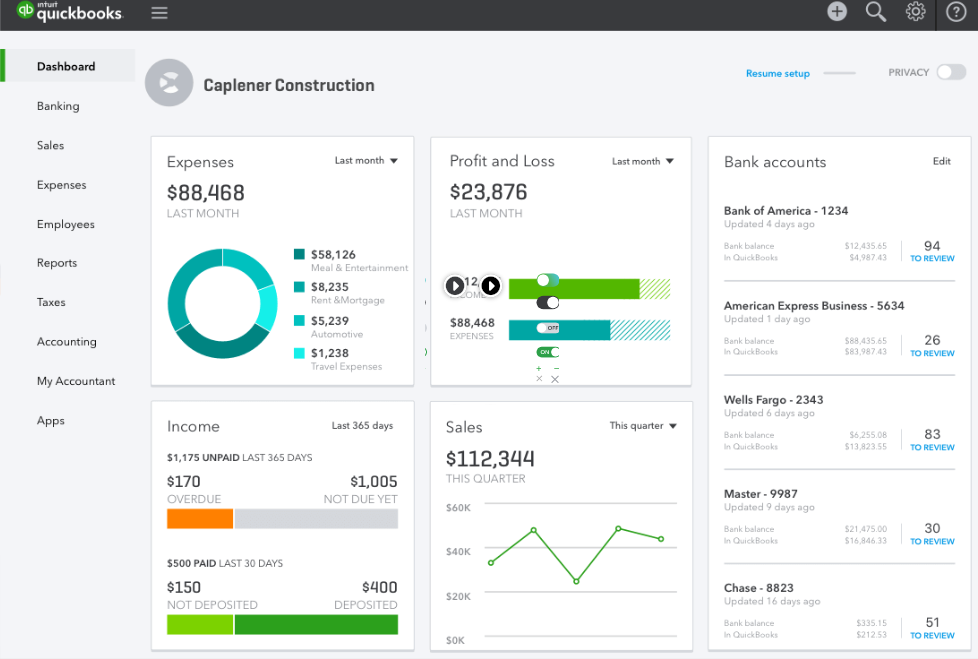

Quickbooks feels clunky, like you’re walking through a ledger with your accountant:

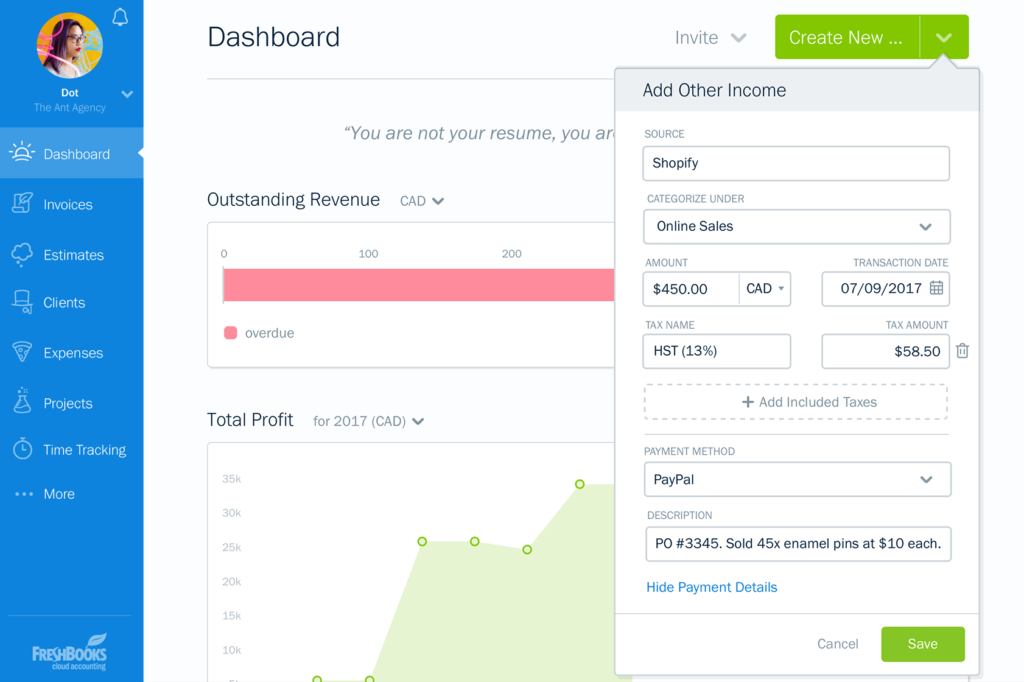

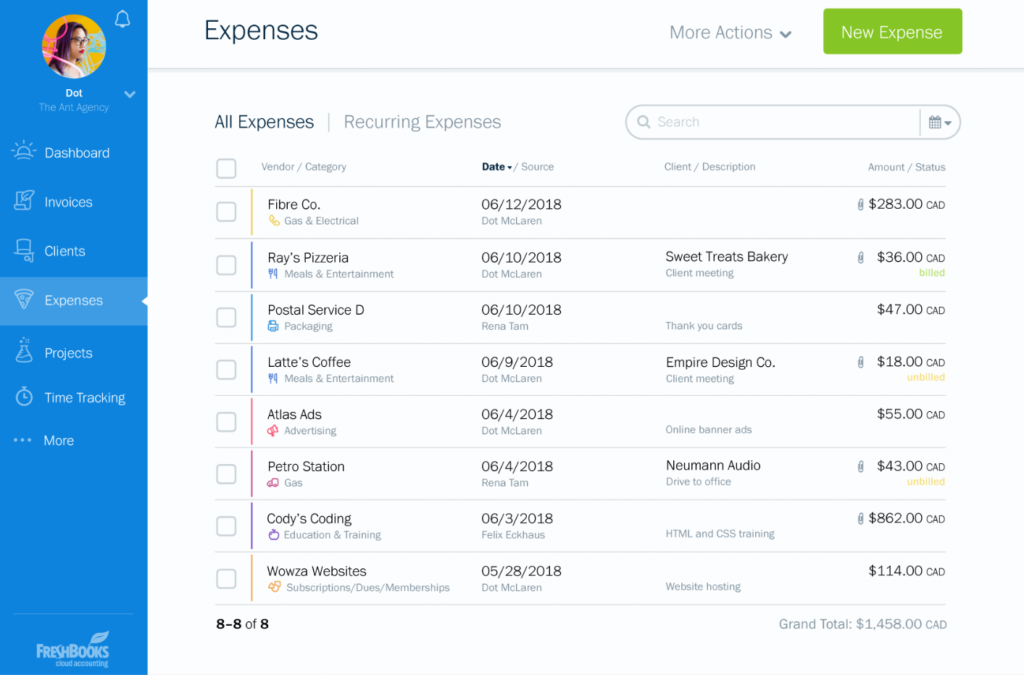

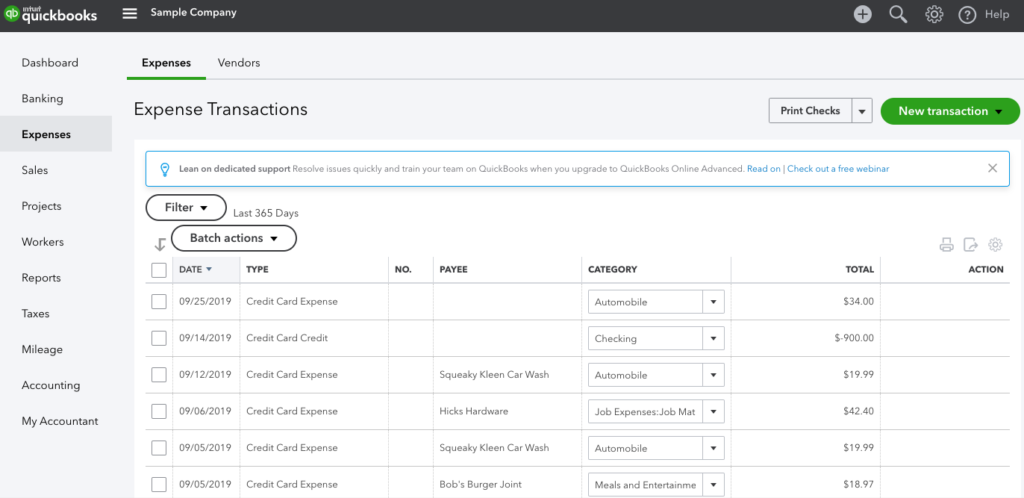

Freshbooks, on the other hand, feels much brighter and easier to use:

The difference here is subtle, but from experience I can say it’s meaningful. You’re going to use this tool regularly, so it’s nice if it’s comfortable and easy to work with. Even better, the tool you use should be so easy that you don’t have to wrestle with it.

This is one of the areas where Freshbooks really shines. In my trials, Freshbooks was much easier to use, to the point where I felt like I was breezing through what otherwise would have been a chore.

Freshbooks has even won several awards for its easy-to-use interface, so it seems like others feel the same way:

Though both products will let you track your expenses, I have to give an edge to Freshbooks here.

Winner: Freshbooks

Invoicing

Both Quickbooks and Freshbooks support invoicing. Here though, the differences between Freshbooks vs Quickbooks are more significant.

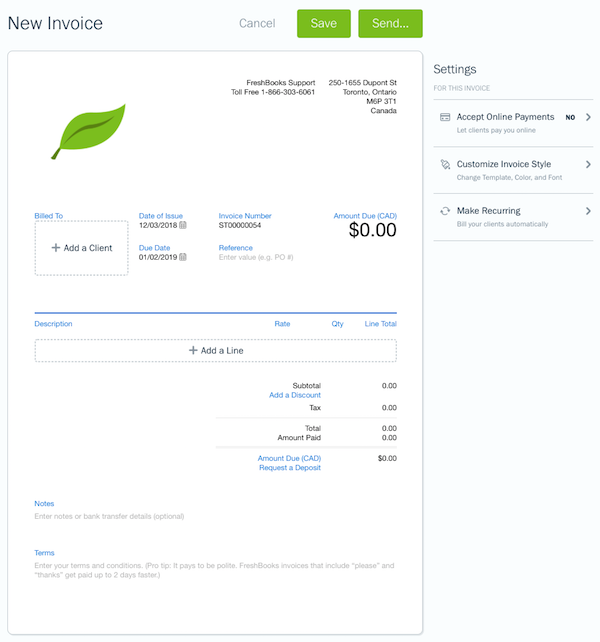

Freshbooks lets you create a simple, visually-appealing invoice. You can add your logo, customize colors and choose a font that matches your brand. This is a nice touch that helps you keep things consistent with your client.

While Quickbooks also supports some customizations, they’re more limited.

Where Freshbooks really shines here, though, is in it’s customizable logic. In addition to making an invoice recurring—which Quickbooks also supports—Freshbooks lets you schedule late reminders, charge late fees, and more.

Both Freshbooks and Quickbooks support online payments, but Freshbooks takes the added steps of supporting retainers, linking invoices directly to time-tracking (see below), and automatically calculating discounts and taxes when applicable.

Overall, Quickbooks gets the job done here, but Freshbooks goes above and beyond, actively saving you time when you create and send invoices.

Winner: Freshbooks

Time Tracking & Inventory Tracking

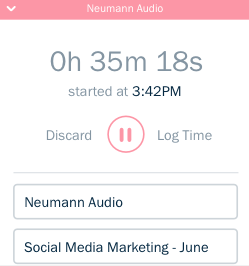

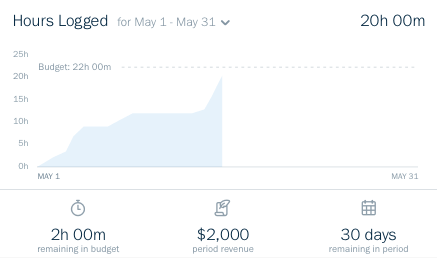

Time Tracking: Time Tracking is a big deal for freelancers and small agencies. Freshbooks offers multiple tools to make your life easy, including a time recorder and a time-tracking grid.

Quickbooks, on the other hand, doesn’t include any real time-tracking features beyond simply entering in time manually on invoices.

Inventory Tracking: If your small business sells physical products, you may need a tool to track inventory. Quickbooks supports a few features that make inventory tracking a bit easier, but they’re limited in scope and you may or may not need a specialized solution.

Winner: Toss-Up – Freshbooks is better for Freelancers and Agencies; Quickbooks may be better for inventory-based business with special needs.

Pricing & Free Trial

Freshbooks offers a Free 30-Day Trial with no credit card necessary.

After 30-Days, if you decide to sign up, you’ll pay $15/month for their lite plan. Their higher tiers offer a few bells and whistles for larger companies and those with more clients, but those just starting out can easily skip them.

Quickbooks also offers a Free 30-Day Trial. Paid plans start at $25 per month, though you can sometimes save a bit if you choose to skip the free trial and enter your credit card on signup.

Freshbooks vs Quickbooks: Overall Winner

By this point it should come as no surprise that when choosing between Freshbooks vs Quickbooks, I definitely prefer Freshbooks.

It’s without a doubt the best option for Freelancers, Agencies, and other small businesses that don’t need to track inventory.